About Us

We are a Wairarapa based advisory business providing personalised service for individuals and businesses looking for advice on protecting their families, their business and their savings. Northco was established in 1981 as Graeme Northcott and Associates. Now more than 38 years later we continue to uphold the same values, placing the client at the centre of everything we do.

Our company has two important affiliations. For our fire and general business we are part of NZBrokers, New Zealand’s largest insurance broking collective. For our life business we are part of NZFSG. Our memberships allow us to leverage the strength and capability of a nationwide group.

Our advisers are qualified as Insurance Brokers and we take responsibility for all our financial adviser services. We abide by a Code of Professional Conduct which includes making sure that our Advisers exercise care, knowledge and skill in providing financial advice to you. Detailed information on our advisers can be found in their disclosure statements.

Our Services

General Insurance

Whether for your home, contents or car or business assets, Northco has access to a wide range of insurance cover from some of the world’s leading Insurers. After a personal assessment, we will present you with tailored solution options.

Our cover can include, house, contents, motor vehicle, farm, farm assets, business assets, marine, liability and travel policies.

We also have a dedicated claims manager handling your claims at no cost to you.

Personal and Business Insurance Planning

We can help tailor an insurance plan for you that ensure you have the insurance protection in place that you need at an affordable cost. You tell us about you and your circumstances and we will work with you to develop the right product options for your insurance needs. Our plans can include the following insurance product ranges:

- Life Insurance

- Trauma Insurance

- Income Protection

- Mortgage Protection

- Health Insurance

- Total & Permanent disablement

Insurance Product Advice and Implementation

If you already know what insurance you want, we can arrange quotes and product options for you. We can then help you implement the products with the insurer and what your insurance policy entitles you to.

Legacy Investment and KiwiSaver Clients

If you have an existing KiwiSaver or Investment Product with Northco Insurance Brokers Limited, we will provide ongoing financial advice.

How We Work

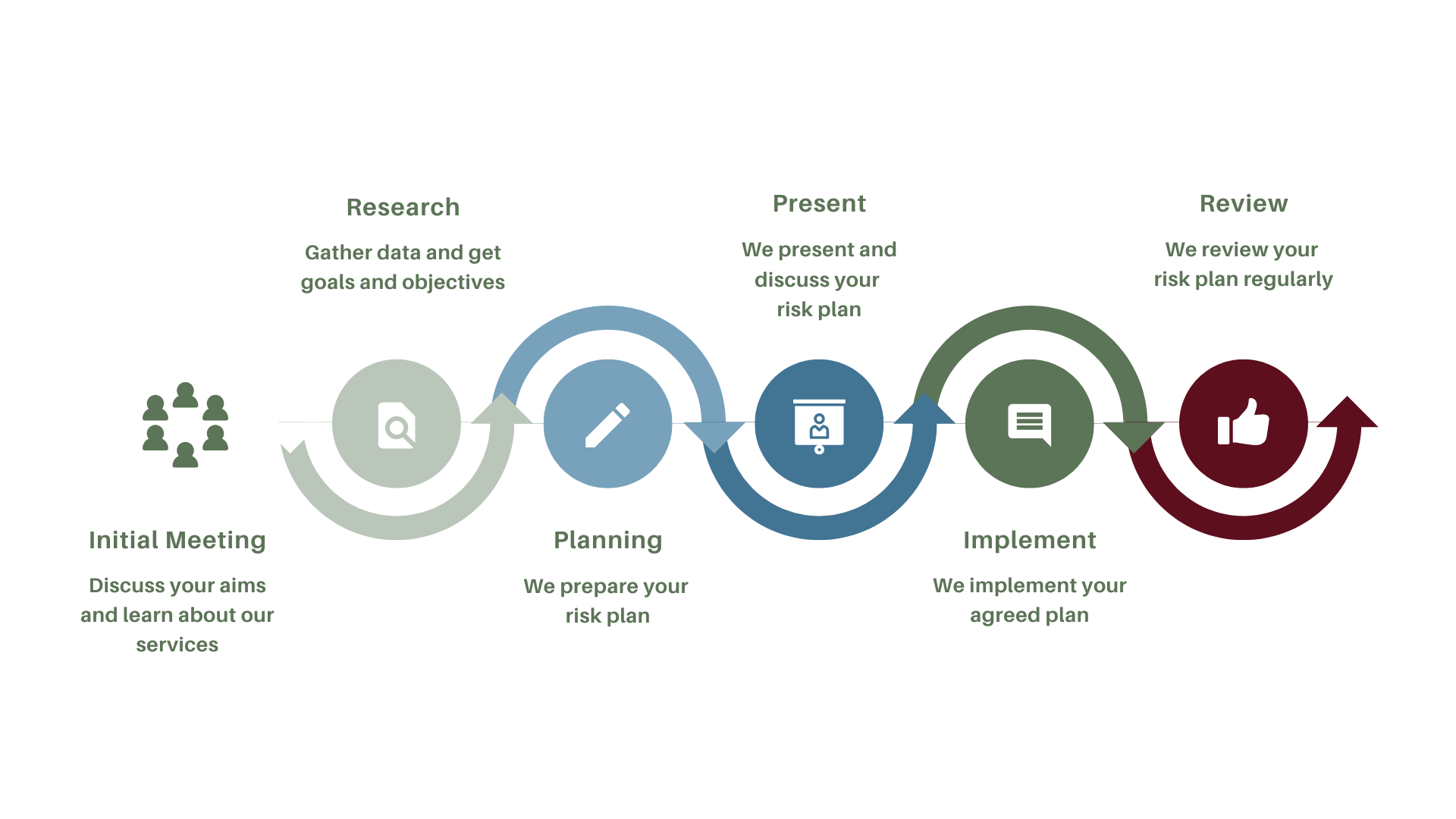

We follow a simple 6 step process when providing advice, and at the centre of the process is you, your lifestyle goals, your barriers, risks and solutions.

- We agree on what type of service you want and identify your requirements.

- We prepare a plan or product options to meet your needs or requests.

- We agree any implementation and other actions to ensure the products work for you.

- All plans are provided in writing.

Our Product Partners

Northco Insurance Brokers advisers work with a group of well-established suppliers with whom we have contractual relationships. This means that we have a close working relationship with these companies and often talk directly to the actual people who manage your insurance policy or investments; people like the insurance underwriters, claims assessors and investment fund managers.

That way we can provide a great level of service and help you get the right results. We are not contractually bound to use any particular insurer. We will discuss with you whom we propose placing your business with and will also advise you of any change in insurers after the insurance has been placed. We receive no additional benefit from dealing with any one insurer.

Professional Bodies

We are members of several industry bodies IBANZ and Financial Advice NZ Limited. As a condition of our membership we adhere to the Code of Ethics and Practice Standards in all facets of our practice.

Professional Indemnity Insurance

We hold professional indemnity insurance which covers our areas of practice as listed above. This insurance provides protection in respect to the advice we provide. The underwriter is: Lloyd’s of London and Chubb Insurance As with all insurance, this cover has limitations and is subject to certain exclusions and terms and conditions.

Advice

Northco Insurance Brokers will have regard to your personal circumstances and objectives as provided by you when providing you with an insurance and investment service. We will provide you with recommendations and advice with a clear rationale for that advice based on your personal circumstances, goals, needs and provide you, the client, the benefits and risks of that advice.

We will negotiate with insurers on your behalf and will keep you informed of any significant developments. We will hold meetings with you as and when required. At those meetings, we will report on matters relating to the insurance programme and will gather information regarding any changes to your circumstances that could affect your insurance.

We will communicate with you in a timely clear and effective manner. We will take steps to ensure that you understand the nature and scope of the advice we have provided including any limitations on the nature and scope of the advice. We will work with you to identify any need, vulnerability or support you require to ensure safe, valued and respected.

We always give priority to your interests. We will only ever recommend a change of product or provider if it is clearly in your interest. In the event you decline to provide requested information regarding your objectives, financial situation or particular needs to us, or provide incorrect or false information, we can only provide you with a Product Only Advice Service or Transactional Services.

If you choose to select a Product Only or Transactional Services, we will therefore not be providing personalised financial advice to you. This means we will not consider all your relevant personal circumstances such as your current situation, needs, objectives or the appropriateness of your requests with regard to the former when actioning your requests, nor provide advice relating to the merits or subject matter of transactions.

Please ask your adviser if you are not sure what type of advice or service you require.

Fees and Remuneration

Unless otherwise agreed, we will be paid a commission by the insurer when you enter the insurance contract that we arrange (this includes renewals and policy alterations). The amount of commission may vary between insurers and types of insurance products.

We charge fees on Fire & General Insurance Policies, to cover our administrative expenses. The nature and total amount of fees that you will be charged for any advice and services, and when and how they must be paid, will be disclosed to you by your Adviser, in your Adviser’s disclosure statement. All fees and charges are quoted exclusive of GST. The amount of GST payable can vary, dependant on the services provided. Any GST applicable will be added to the quoted fee or charge and is payable by you.

All specific fees will be agreed upon as part of our Disclosure Statement. Your adviser will set out the remuneration they receive in the disclosure statement given to you when providing you with advice.

Procedures for Dealing with Client Premium Payments

We cannot use your money or securities for another client’s benefit or to pay our own expenses. We operate a premium trust account for the depositing and paying of insurance premiums. This is audited by the FMA. We utilise a Premium Funding Facility for clients to spread the cost of their insurance payments. This is a Finance Company and is separate to Northco Insurance Brokers Limited. This Finance Company is regulated by the DIA.

Privacy

I/We need to collect your personal information for the purpose of:

Evaluating and determining your request for advice;

Maintaining relevant records and advice reports.

In providing our adviser services to you, you consent and give authority to me/us to obtain your personal information from or disclose your information to, the following parties:

the Regulator and external compliance personnel or any service provider when implementing any of my/our recommendations or variations thereof and/or supplying products to you;

compliance advisers/personnel, product providers whom I/we have an agreement with, insurance companies, any claims investigators and claims assessors, ACC, financial institutions and any other persons or agencies deemed relevant;

other professionals such as solicitors, accountants, finance brokers, financial planners when such services are required to complement this advice, and/or as requested by you;

any other individual or organisation where disclosure is required by law.

In providing our adviser services to you, you consent to your information being used by me, members of our staff, and administrators on our behalf, product providers whom I/we have an agreement with, reinsurers and other companies for the purposes for which your information was collected.

The information is held by me at the offices listed in this document and on our systems, some of which are cloud-based. Under the Privacy Act 2020, you have the right to access and correct your information that I/ we hold about you. I/We will rely on you to keep us informed of any changes to all of your contact details and any other personal information.

If you wish to obtain access to or correct your information about you please contact me/us. You agree to provide all additional information as requested by us and comply with all reasonable requests from us to facilitate our compliance with AML/CFT Laws.

Northco 2020